How Delta Airlines is Turning Loyalty into Revenue: The Data-driven Strategy Behind Full Flights

Data Analytics Sprint with Clicked

For Delta Airlines, loyalty is no longer just a point system; it’s a strategic asset in the revenue playbook. In a market constantly challenged by fierce competitors, and pricing wars with low-cost carriers, Delta has found an edge by reimagining loyalty data as a dynamic tool to fill seats and boost revenue during low-demand periods.

Thank you to Clicked, (now Ziplines) for providing another opportunity for data enthusiasts like me, who enjoy sprints and pressure-challenges to take a break from mindlessly scrolling through resources and settling on something educating, and networking with other like-minded people.

Now, this was no easy task. The data is intimidating, siloed data is my least favorite kind of data but when Rachel(Business Analyst) in Operations says you can do it, you have to know that she means it and she believes you can, even when you don’t.

So, let’s get into this.

Imagine this: instead of standard and blanketed promotions, Delta’s data scientists can unlock specific customer insights — like past travel behavior, spending on snacks, or using the lounges to predict who is a ride or ride Delta customer, and use this to tailor promotions and rewards to their loyal customers.

How? Customer Segmentation. Using customer loyalty scores, and all these other metrics, they can use these to deliver offers that are not just timely but strategic. This shift from blanket discounts to personalized value propositions can transform loyalty from a marketing tool into an operational wiz.

How can this be done:

By focusing on predictive loyalty analytics. Airlines can identify low-demand periods in advance and optimize seat occupancy through targeted offers.

The analysis focused on predictive and human analysis by combining these factors with metrics like Passenger Revenue per Available Seat Mile (PRASM) and launching personalized offers that turn low-occupancy flights into fully booked ones.

In this data sprint, our team applied predictive analytics to Delta’s loyalty data, segmenting frequent fliers by their responsiveness to discounts. Using PRASM alongside loyalty scores, we identified high-impact customer segments who are likely to book during non-peak times when offered tailored discounts or upgrades.

The result? A projected occupancy increase during not-so-busy periods — showing that data-driven loyalty programs aren’t just about keeping customers happy; they’re about smart, real-time revenue management.

Here’s a brief look at the analysis and findings:

Data Standardization: Using Delta’s loyalty and PRASM (Passenger Revenue per Available Seat Mile) datasets, we cleaned and standardized data across Frequent Flier, Upcoming Flights, and 3-month Upcoming Flights sheets, and handled missing data to ensure accuracy and consistency.

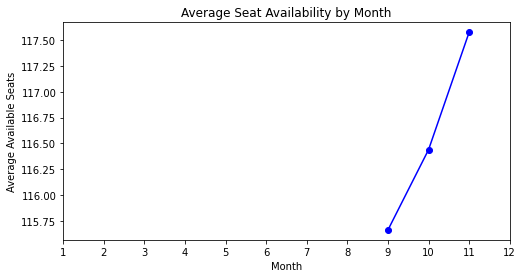

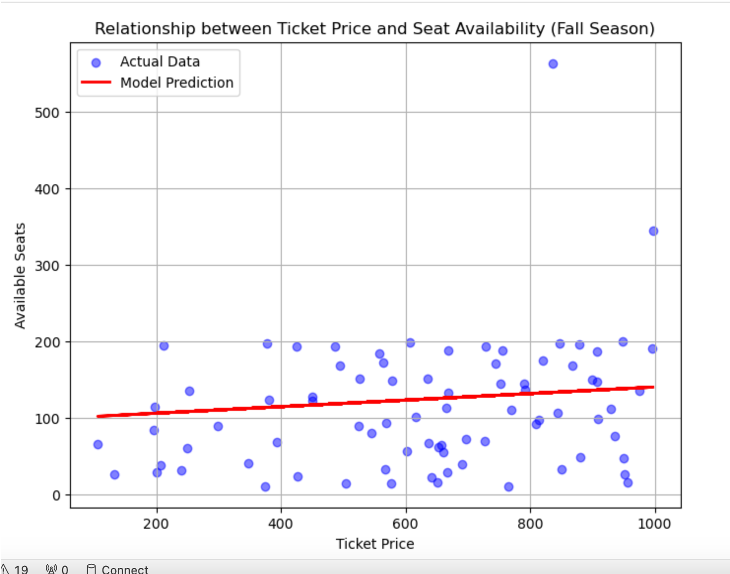

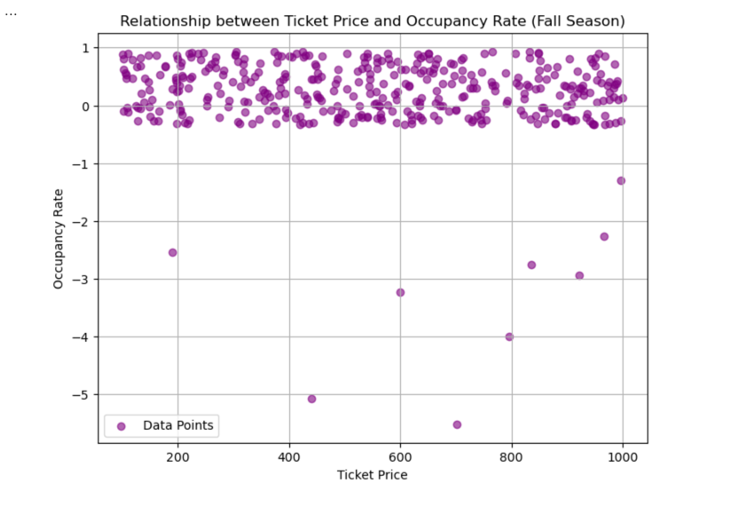

Exploratory Data Analysis (EDA): Conducted EDA to uncover baseline insights across the datasets. Through visualizations and summary statistics, we identified trends in ticket prices, seasonality in demand, and loyalty engagement patterns. Some observations were variability in seat availability by month and ticket price distributions that suggested certain months (notably the fall season) had higher occupancy despite elevated prices.

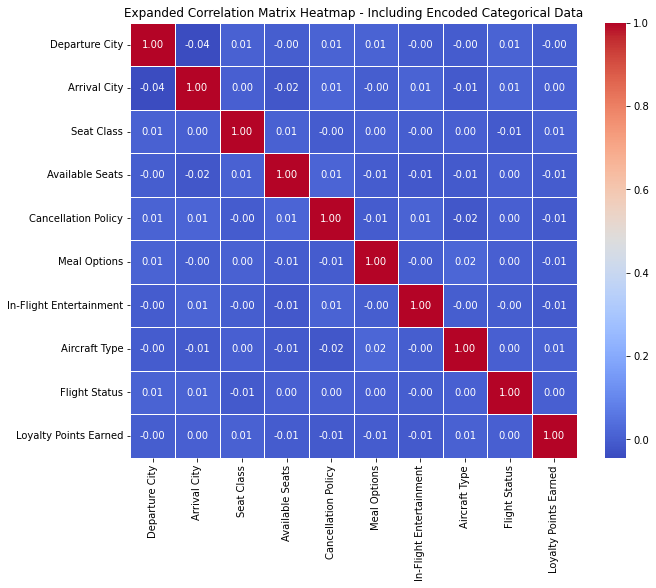

3. Correlation Analysis: Explored correlations across variables, finding that while most relationships were weak, a slight positive correlation existed between the cost of a flight and the likelihood of purchasing add-ons (e.g., car rentals, hotels). This correlation indicates potential upsell opportunities for high-spending passengers.

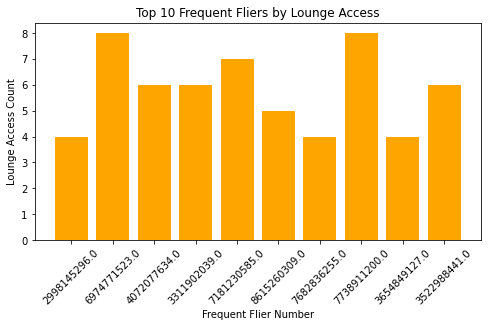

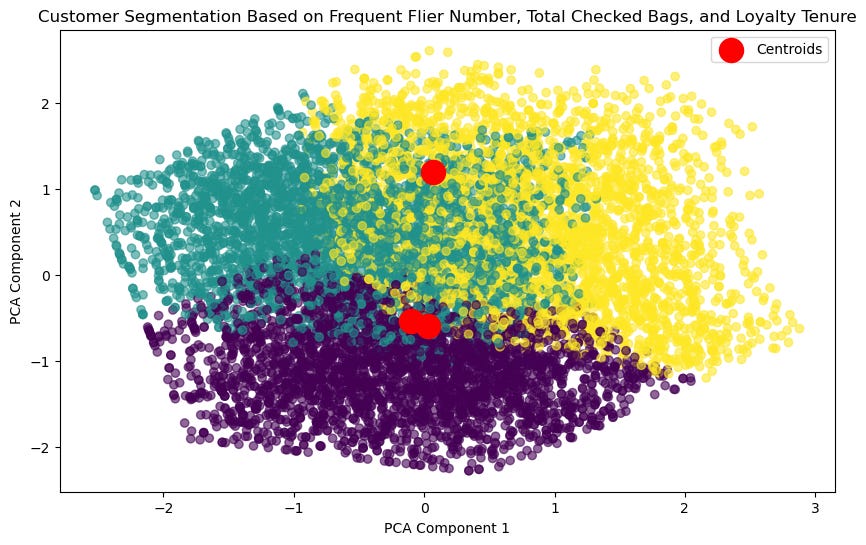

4. Customer Segmentation & Clustering: Used unsupervised learning to segment customers based on loyalty and engagement metrics, revealing distinct customer groups. Clustering helped identify high-loyalty members who could be rewarded to sustain engagement, while low-loyalty groups may respond better to targeted promotions.

4. Seasonal Trend & Revenue Analysis: After analyzing occupancy and pricing trends across seasons with PRASM (Passenger Revenue per Available Seat Mile) data, one key insight emerged from this analysis: people are always traveling, especially during the fall season. Occupancy remained high even when ticket prices were above average, revealing customers’ willingness to pay more during this period.

5. Comparative Analysis of Price & Occupancy — By comparing occupancy rates with ticket prices, I identified that, particularly in the fall season, seats were filled even at higher prices. This insight can be a strategic lever for Delta, suggesting they can maintain premium pricing during fall while still achieving high occupancy, reducing the need for broad discounts. Dynamic pricing in action.

6. Predictive Modeling for Loyalty Levels: Built a logistic regression model to classify customers as high or low loyalty based on factors like Frequent Flier Number, Price, and Loyalty Tenure. However, with a 52.2% accuracy, the model had limited predictive power, suggesting a need for more refined features or balanced data to improve predictions.

Results & Findings:

This analysis showed that targeted offers could increase occupancy in select markets during low-demand periods.

This data-driven approach can keep seats filled and also enhance customer satisfaction by delivering value when it matters most.

You can find the full analysis and code for this project on my GitHub, where I detail each step and provide code for replicating the results.

Recommendations:

Leverage Seasonal Price-Occupancy Dynamics

Use the Fall season as a benchmark period to maintain dynamic pricing without risking occupancy drops. For future analysis, Delta could test small incremental price adjustments within this season to optimize revenue while preserving high seat occupancy. This is from a business perspective.Refine Targeted Offers for Specific Loyalty Tiers

Use insights from segmentation and clustering to target specific loyalty tiers, particularly during low-demand periods. Customized promotions for mid-loyalty customers can boost engagement without broadly discounting fares. Tailoring discounts and upgrades based on loyalty tier preferences can prevent unnecessary revenue losses. An automated system can be implemented to push offers only to segments with a high response likelihood, focusing on cost-sensitive tiers in low-demand periods.Data Tuning for Noise Reduction

This was a 3-week program so I was limited by time but to increase model accuracy, fine-tuning the data by eliminating outliers and standardizing variable formats will give more precise findings and accuracy. Removing noise (e.g., inconsistent loyalty score entries and date formats) will enhance predictive accuracy. Additionally, by smoothing weekly booking patterns, precise trends can be captured, and the models can better identify booking windows that respond to specific offers.

For Delta’s analytics team, the message is clear: loyalty can be more than retention. By treating it as a revenue engine, Delta can turn every data point into an advantage, meeting customers where they are with offers that fill seats and strengthen loyalty.

Human analysis, people analysis — that is where data can be and should be used to shape real-world impacts.

Be data-informed, data-driven, but not data-obsessed — Amy

Link to codes: https://github.com/YummyAmy/Data-Analytics-Sprint-Delta-Airlines

Disclaimer: This analysis is based on a data analytics sprint with Clicked and might not represent the complete range of customer analysis in Delta Airlines.

Biz and whimsy: https://linktr.ee/ameusifoh

Connect with me on LinkedIn for more data analytics.

Ok let me start by saying I loved your analysis and the post as a whole! It's inspiring as someone who's trying to create similar content.

"For future analysis, Delta could test small incremental price adjustments within this season to optimize revenue while preserving high seat occupancy. This is from a business perspective."

I kinda hated the point above lol, I get where you're coming from, Delta it's a business so money talks. However I can't fight feeling like this is penalizing loyal customers at the expense of revenue. It kinda made me think about how T-Mobile offered the best plans and perks to new customers and didn't offer any goodies to existing customers (yeah not projecting at all...)

I put a heart on it but I don't love this.